Analysis

To understand the distribution of sources of various criminal robocalls, it is first helpful to understand some important points from academic criminology.

Within criminology, the Pareto Principle holds that most crime is committed by a small portion of criminals. This is commonly expressed as the “80/20” rule where 80% of crime is committed by 20% of criminals. Empirical and statistical evidence shows a relatively small number of criminal groups are responsible for the large majority of robocalls.

Differential association is the theory that individuals are more likely to commit crime if they are in social groups where the normative values in favor of committing crime outweigh the normative values opposed to committing crime. Learning theory holds that criminals learn how to commit specific crimes from other criminals.

As a practical matter, this manifests as a tendency for criminals who commit specific types of crime to be in the same homogeneous social groups as other criminals who commit the same types of crime. This is highly observable in criminal robocalling. For example, 90% or more of law enforcement impersonation calls come from India. Yet less than 1% of law enforcement impersonation calls come from Pakistan. 90% or more paid TV provider impersonation calls come from Pakistan. Yet less than 1% of paid TV provider impersonation calls come from India.

Empirical and statistical evidence shows that specific types of robocalls primarily come from common sources.

- Most law enforcement impersonation calls (including IRS and Social Security) come from India.

- Most tech support impersonation calls come from India.

- Most Amazon impersonation calls come from India.

- Most electric utility impersonation calls come from the Dominican Republic.

- Most paid TV provider impersonation calls come from Pakistan.

- Most lottery/sweepstakes robocalls come from Jamaica.

- Most “grandparent scam” robocalls come from the United States and Canada.

- Most false kidnapping scam robocalls come from Mexico.

- Most travel and tour telemarketing calls come from Mexico.

- Most timeshare related scam robocalls come from Mexico.

- Other types of scam calls specifically targeting Latinx or Chinese speaking communities come from Latin America or Asia.

- Immigration Agent impersonation calls targeting foreign exchange students (most victims of which are from China) originate from India.

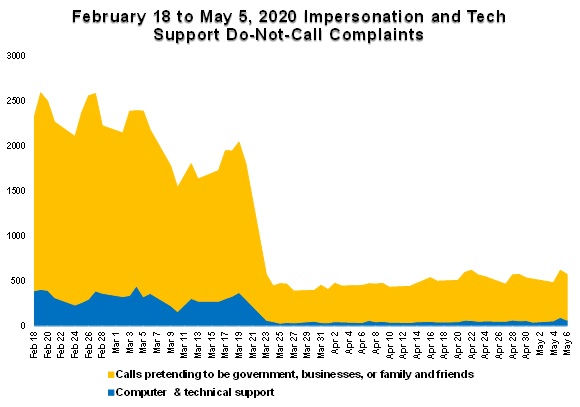

Most prima facie criminal scams originate from outside the United States, primarily from India. This is based on the totality of call traces and other statistics over the past seven years. For example, in 2020 impersonation and tech support robocall complaints to the FTC declined 77% on March 23—the day COVID lockdowns were announced in India.

Robocalls of an abusive or semi-criminal nature, deceptive business practices, and calls that are only potential TCPA violations primarily originate from entities within the United States. Such calls include:

- Extended car warranty offers;

- Health insurance enrollment;

- Student loan forgiveness; and

- Credit repair.

In many cases, these types of robocalls may have been made outside the US and then “warm transferred” to US businesses after a nominal “screening.” This is done so that US businesses have deniability about how calls were originally made.

Since different types of robocalls have homogenous sources, this distribution of sources can be roughly determined by classification of robocall types in Do-Not-Call complaints made to the Federal Trade Commission.

A money mule is an individual who acts as an intermediary in moving funds from a scam victim to a scammer. Some money mules are knowing co-conspirators, others have been dupped into believing they are participating in legitimate business. Money mules provide a variety of functions.

- They cash out gift cards.

- They receive checks, gift cards, and cash mailed by victims.

- They receive deposits and wire transfers from victims.

- They then transfer funds received from victims to scammers.

It should be noted that overseas criminal groups are not entirely dependent on the use of domestic money mules. Money mules are a convenience. They are not a necessity. Common methods of moving money from victims to scammers without the use of a domestic money mule include:

- Reselling gift cards online;

- Cryptocurrency ATM deposits or transfers;

- Offering games or apps for sale on Google or Apple app stores and purchasing them using gift cards provided by victims.

In many cases, domestic money mules are vertically integrated within India-based criminal groups. However, investigation of money mules by law enforcement can sometimes provide a distorted view of the sources of criminal robocalling when money mule networks are entirely separate from criminal robocalling groups. Chinese, Latin American, West African, South Asian, and domestic money mule and money laundering networks have commonly hired out to India-based criminal call centers while also hiring out to other fraud groups at the same time.

Such investigations become especially challenging when money mule networks are poly crime groups working for several different types of criminal enterprise. Sometimes, tracing phone calls is faster and more efficient than tracing illicit funds.

Industry traceback data sometimes overstates the frequency of criminal robocalls originating from inside the United States. This is because trace attempts are sometimes not completed. Upstream providers may decline to respond after a certain point. Other times trace attempts are stopped when the first US provider is identified.